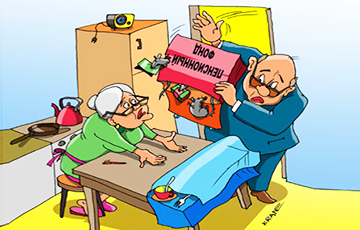

Secrets of the Belarusian Billion. How Is Money of Pensioners Spent?

44- 21.11.2019, 9:05

- 78,414

There's a huge hole in the SSF again.

The Social Security Fund, from which Belarusians receive pensions and benefits, has been experiencing a lack of funds.

Therefore, next year the budget will transfer almost a billion dollars to it. At the same time, there is no improvement in the quality of life of pensioners in the country. Why has the SSF turned into a "black hole" in the Belarusian economy?

Leu Marholin, an economist, answers questions of Charter97.org.

- Belarus has one of the highest percentages of deductions to the SSF among the post-Soviet countries (35% of the salary). Why is this money constantly not enough and there is a "hole" of $1 billion in the fund for 2020?

- I would mention the recent retirement age increase, which would also seem to help solve this problem.

The fact is that the demographic composition of the population in all countries makes the issue harder to resolve without a solidarity-based pension system.

And so, all market economies replenish the pension fund from several sources. These are guarantee payments, voluntary personal savings of citizens, an employer's contributes to the fund.

We don't have it, and apparently, we won't have it in the near future, because it requires a market economy, which we don't have. Therefore, it is what it is.

- The state has already allocated billions of dollars to patch holes in the SSF. Is there a guarantee that this money will reach pensioners? Is there any way to check where and how this money is spent?

- There is no way to check this, because, as they say, we live in the wrong country.

But why is this happening in our country? Why does the SSF suffer a permanent shortage of funds?

It is also determined by a high level of concealed unemployment. People who have to go to Russia, Poland, Lithuania to earn money either do not participate at all in the formation of the pension fund or do it in those countries where they work. They spend the money they earn here. Both pensioners, their parents and all other relatives live here. This imbalance is also noted worthy.

If we could bring all these people back here, create jobs for them, the situation would change significantly. I think that with such a percentage of contributions to the SSF (35% - ed.), there would be no questions about subsidies.

- Recently, Minister of Labour and Social Security Iryna Kastsevich voiced interesting figures: self-employed Belarusians practically do not pay contributions to the pension fund. That is, the category of people, whose pension depends only on their contributions, do not trust the state. What does it mean?

- I think that here there is a combination of several reasons.

Of course, there is distrust in the state institutions and in particular in the SSF. The self-employed believe that they should rely only on their own.

When you wonder why they don't you think about their pension, they say that one should save for a pension on one's own.

On the other hand, the self-employed are the last group among entrepreneurs, the smallest one. If the activity is even a little bit broader, the person is an individual entrepreneur and is registered and must pay contributions to the SSF.

These are the people who are desperate for money. Therefore, they do not trust the SSF and they have no extra money to pay.

Finally, there are a lot of people of pre-retirement age among these people and they paid enough time to the fund to ensure some pension.

- For years, the SSF has received subsidies from the state budget, and the "hole" in it is growing wider... What steps can the authorities take to "solve the problem"?

- There are few steps to take.

The first is to increase the percentage of contributions, which means to further worsen the investment climate here.

The second is to raise the retirement age. I think that as soon as three years planned for the retirement age increase pass, they will likely announce an "unplanned" increase of the retirement age by another two years.

Because there are no other options. If the economy is not reformed, if there are no fundamental reforms in the pension system, then everything else is of a palliative meaning. One may pay from the budget, raise the retirement age, or increase the percentage of contributions to the SSF - all these are useless in strategic terms.

- What would be the fate of our pension system if political changes happened and the country followed the market way?

- It would mean the growth of salaries.

It would stimulate the growth of pensions as well.

The average salary and the number of jobs would increase, which meant greater contributions to the SSF. It would cause the pension growth.